Paying when energy prices are negative? Here's how the Embion EMS helps.

Negative energy prices are increasingly becoming a reality in the energy market. This happens when there is a surplus of electricity, for example due...

The energy market is changing rapidly. Where fixed contracts with peak and off-peak tariffs used to be the standard, we now increasingly see dynamic contracts. In these contracts, every hour of the day has its own price. Starting from October 1, 2025, this will even change to every quarter of the day. That may sound complicated, but it actually creates opportunities for organizations that use their energy smartly. With the right combination of market knowledge and technology, your flexibility suddenly becomes extremely valuable.

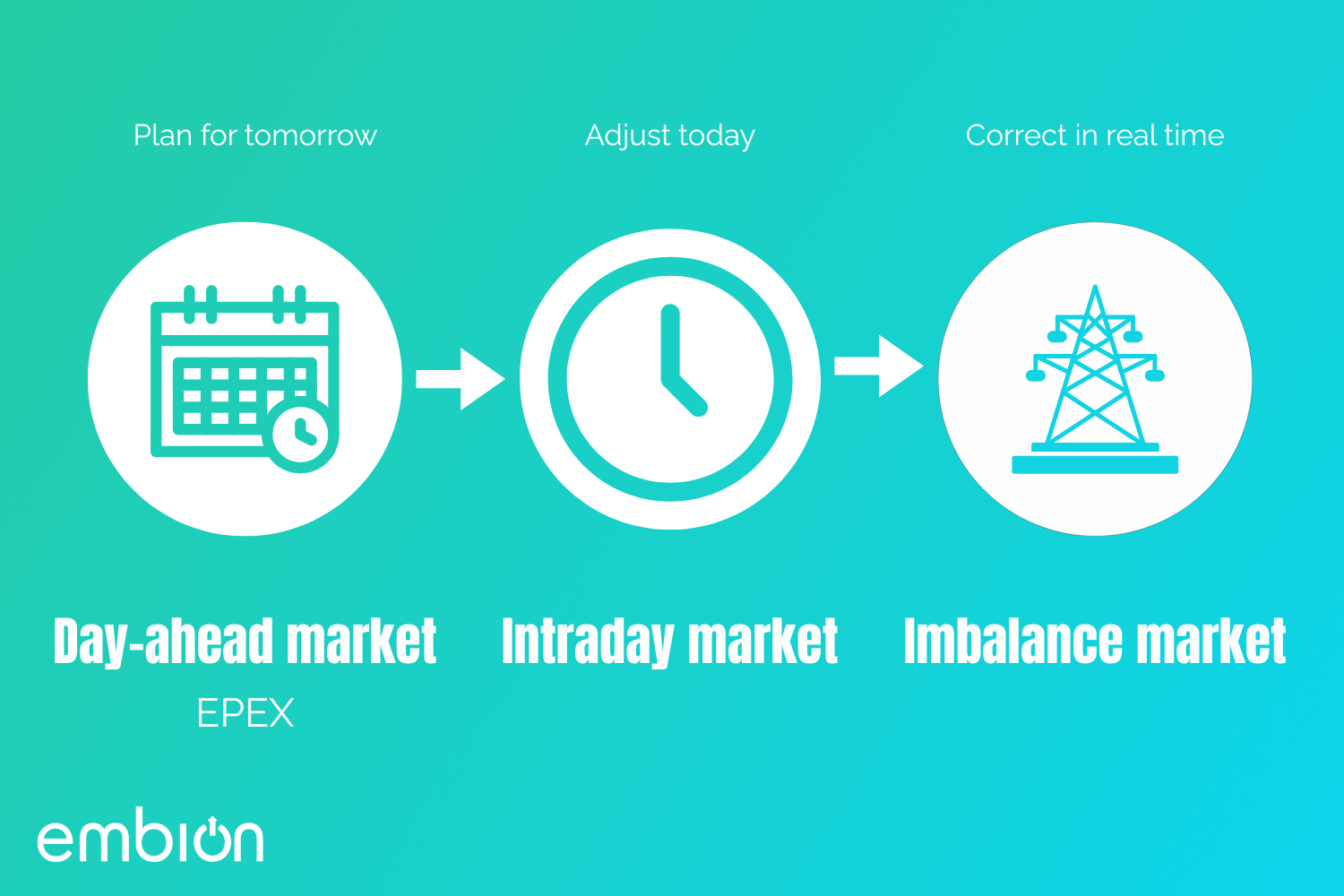

Most organizations are familiar with the EPEX day-ahead market. Until now, prices here have been set one day in advance per hour. Starting in October, this will change: prices will then be set one day in advance per quarter-hour. These prices move with supply and demand. At night and around midday, electricity is often cheaper due to low demand or high solar and wind production, while prices rise during the morning and evening peaks. With a dynamic contract, you can save by shifting consumption to cheaper times.

Between the day-ahead market and the imbalance market is the intraday market. Here, parties can trade electricity until just before delivery. This provides the ability to correct forecast errors or respond to changing conditions, for example more or less wind or solar energy than expected. Intraday prices closely follow real-time market developments and are often more volatile than day-ahead prices, but they provide greater flexibility to align supply and demand closer to real-time.

In addition to EPEX and the intraday market, there is the imbalance market. This market is not about forecasts or trading, but about the deviation between scheduled and actual production or consumption. If you use more than planned or produce less, you pay the imbalance shortage price. If you use less or produce more, you receive the surplus price. These prices are often less favorable and can even become negative, for example when there is unexpectedly high wind or solar output.

The EPEX market therefore offers opportunities to trade smartly, the intraday market provides flexibility to react to changing conditions, and the imbalance market brings risks that need to be managed carefully.

To manage those risks, the trader plays a crucial role. They buy and sell energy on the EPEX market, make forecasts of consumption and production, and are program responsible towards TenneT. In doing so, they reduce the likelihood of high imbalance costs.

Still, the weather remains unpredictable and no forecast is perfect. This is where flexibility in installations becomes highly valuable, and our technology comes into play.

While the trader ensures a strong market position, the Embion EMS translates this into automatic actions within your installation. Our system connects market information with the flexibility of your assets. For example:

Batteries that charge or discharge at the most favorable time

Charging stations that respond to price fluctuations

Solar panels that are optimally used or temporarily curtailed at negative prices

Heat pumps that shift their consumption to hours with low EPEX tariffs

Everything happens automatically and in a clear way. You do not need to take any action but still benefit from the advantages.

The combination of trading and technology means that your energy is no longer just a cost factor but a strategic advantage. By leveraging EPEX prices while managing the imbalance market, you reduce costs, increase reliability, and contribute to a more stable grid.

With the Embion EMS, your flexibility is maximized. This ensures you are not only prepared for today’s energy market but also for tomorrow’s.

Negative energy prices are increasingly becoming a reality in the energy market. This happens when there is a surplus of electricity, for example due...

Starting April 1, 2025, a new subsidy scheme will be available for companies looking to invest in flexible energy use. The Flex-E grant makes it...

Once your company has an electricity connection greater than 3 x 80 amps, in the Netherlands, you are classified as a large-scale energy consumer....

The energy transition is no longer a matter of the future, it’s the reality of today. Wind, solar, and the electrification of mobility and industry...

On January 23, the OStuTech event took place, where the latest developments in energy management were discussed. This event provided valuable...

Electricity grids are becoming overloaded, regulations are evolving rapidly, and pressure on the system continues to grow. In short, the energy...